6 Common Mistakes Startups Make In The First Six Months of Business

Starting a business is not easy. There are so many decisions to make and complex challenges to overcome. That is why many entrepreneurs make mistakes in the first few months of operations.

Explore six of the most common mistakes startups make and learn how you can avoid them.

The Top 6 Mistakes Startups Make in the First Six Months

1. Running out of cash

2. Making expensive hires

3. Focusing on anything other than product and sales

4. Approaching funding sources too early

5. Being too generous with equity

6. Failing to plan for the future

1. Running Out Of Cash

Developing a solid cash flow is an essential aspect of any business, whether it has been operating for 10 days or 10 years.

However, it will likely take you some time to gain customers and build up your cash flow. The worst situation you could find yourself in is running out of cash before you generate cash.

For a time, you will have to rely on the cash in the bank. So, you need to think about whether or not you’ve set aside enough.

In our experience, we’ve seen that it is probably going to take you longer than you think to reach the level of activity needed to sustain your business.

Make conservative decisions with your funds, like not purchasing excess inventory or not taking a paycheck until your cash flow is improving or the business has received an investment from a third party.

2. Making Expensive Hires

While you do want experienced professionals on your team, save those big salary hires for after you have secured a stable flow of profits.

For the first few months of your startup, do your best to operate with just the essential positions. That means you will have to take on a heavy load of responsibilities.

However, this frees up cash flow and resources to allocate to other areas of your business.

If you truly believe that an expensive hire will drive your growth and help your business succeed, consider offering equity in the company. Not only will it make a hire more cost-effective at the time, but it will give them a sense of ownership in the company.

3. Focusing On Anything Other Than Product Or Sales

A common startup mistake many make in the early stages of operations is being too ambitious with plans or goals.

Focus exclusively on the key aspects of your business like product development or sales. If it is an initiative like changing the server you use or renovating your office, set it aside until after your business is stable and operating efficiently.

Once you have the basics of your business on track, you can set your sights on additional projects.

4. Approaching Funding Sources Too Early

If you approach funding sources before you are ready with a solid presentation and pitch for investment, you risk losing the potential investment.

If your startup does not have a fleshed-out business model or a viable client base, investors will be hesitant to get on board. Because you only have one shot at a first impression, you need to ensure that you are fully prepared to make a compelling pitch to your potential funding sources.

5. Being Too Generous With Equity

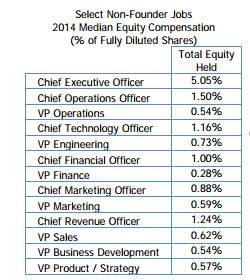

A typical startup mistake is being too generous with equity or offering too much of it to too many people. Benchmarks exist that can help you understand how to allocate equity. It is typical for an early-stage company to issue 15%-20% of equity, but you should be judicious about who you issue that equity to.

*Example of the median equity compensation issued to executives of venture-backed companies in 2014.

Be sure to keep track of everything with a cap table. A capitalization table (or cap table) is a table providing an analysis of the founders' and investors' percentage of ownership, equity dilution, and value of equity in each round of investment.

Research norms for your industry or consult a financial advisor to determine if your investors' percentages are fair.

6. Failing To Plan For The Future

Spend your first six months in business building a foundation for your future business practices. You should enter the next stage with a business plan focusing on your goals and the direction you want your company to go.

Our team discovered a lot of good tips for developing our strategy in Verne Harnish’s book, Scaling Up. We’ve made it required reading for everyone on board. It has helped us think more strategically about our long-term objectives to develop both company and personal goals that will help drive growth.

Whether focusing on what we need to start doing, stop doing, and keep doing within our industry or defining the who, what, and when for our strategic priorities, we’ve developed habits that are helping us better plan for the future of our company.

Our recommendation to you is to set time aside to reflect on the past few months of operations and use the lessons you learned to develop a solid plan for the future of your startup.

Schedule a free consultation with Gene Godick, President of G-Squared Partners, to learn more about avoiding these six mistakes.